In my last post, I outlined an evolution of credit origination due to a shift in demographics, the economy and technology. In part II of this series, I’ll dive deeper into why these changes are impacting how lenders think about credit risk models.

Risk models as a competitive advantage

Credit models for prime borrowers (FICO 660+) have historically been very straight forward, typically using a segmentation of applicants based on their credit score, a handful of financial indicators and some disqualifying knock-out rules (such as a bankruptcy). There was not a lot of motivation for prime lenders to innovate on credit risk models and they focused instead on competing for the same consumers on price.

In non-prime credit markets, lenders are more motivated to look beyond an applicant’s traditional financial indicators to find that ‘needle in the haystack’, where someone with a non-ideal credit score represents an acceptable risk.

Changing demographics, generational attitudes and global economic events including covid are forcing lenders across credit spectrums to look for more creative ways to model risk while keeping a sharp eye on regulatory impact.

Lenders deploying next-generation risk models have seen revenues increase by 5 to 15 percent

McKinsey

Innovative lenders and FinTechs are applying emerging data and technology to create more targeted, real-time and accurate credit risk models. Lenders who do not evolve will find themselves losing in the competition for the highest value customers. According to a McKinsey Insights, lenders deploying next generation credit models have seen revenues increase 5 to 15 percent through higher acceptance rates, lower cost of acquisition and a better customer experience. An even bigger concern for lenders who do not evolve their credit risk models is that they will start to absorb higher-risk customers passed over by sharper credit instruments.

Today’s borrowers are evolving

There are multiple factors impacting the credit industry’s customer segments. As Millennials and Generation Z become the dominant consumers of credit, non-traditional attitudes towards employment and finance are making them less predictable using traditional models. Excessive student debt, delays buying cars and homes, less loyalty to financial institutions and economic impacts of the pandemic make it harder to classify applicants. As a result, traditional credit scores and underwriting models are becoming less effective.

At the same time, an increasing population of immigrants do not have an established US credit history. These applicants can represent a great opportunity for lenders able to efficiently make underwriting decisions using non-traditional means. Emerging alternatives like NOVA Credit can help lenders access these populations, but not without rethinking their approach to risk modeling.

Finally, borrowers’ have increasing expectations for a frictionless credit origination experience. Groomed on instant access to information, the next generation of borrowers have little patience for a drawn our application process where lenders request information that can be accessed electronically.

Credit scores and financial ratios are no longer enough

The heart of a credit decision is a calculation of the probability the credit will be repaid or the relationship will be profitable. Traditional risk models analyze historic credit performance across large populations and formulate risk ‘buckets’ that can be used to segment new applicants. These segmentations can be represented as simple thresholds, or they can be combined into non-linear models that capture interactions between financial attributes.

For example, someone’s debt-to-income ratio and the level they utilize their revolving credit are two predictors of credit risk that have non-linear correlation. A higher credit line utilization is less concerning for applicants whose debt is a small percentage of their income – their use of credit is likely a convenience. Models like the FICO score combine multiple financial indicators in ways that are statistically predictive of risk.

The limitation of traditional credit models is they are relatively blunt instruments. Aggregated financial indicators hide details about an applicant’s financial situation that could be useful in assessing risk. More importantly, deeper insights can identify deserving applicants whose financial indicators do not line up with the rest of the population.

As our evolving culture and economy introduce more variation in what is considered ‘standard behavior’, credit models must evolve past the traditional segmentation of applicants. Not only will next-generation credit models deliver better results for lenders, they will be more fair for applicants with non-traditional financial histories and more transparent to regulatory scrutiny.

Alternate data for better underwriting decisions

In the last decade, there has been an explosion of new data sources and aggregator services available to lenders that deliver insights into consumer behavior. Many of these data sources, such as banking transaction data, require opt-in from the consumer. Younger generations tend to be more willing to share data, having grown up in the ‘put it all out there’ culture of social media.

Using alternate data result in 20 to 40 percent efficiency gains.

McKinsey – Designing Next-Generation Credit Risk Models

Used responsibly, data such as utility bills, driving records and banking transactions provide a wealth of insight that can help lenders differentiate good and bad risk while underwriting credit. In addition, use of this data can help create a more frictionless origination experience (the topic of my next blog) by allowing the lender to instantly verify applicant information such as income and bank balances. Lenders using alternate data to automate credit models have seen 20 to 40 percent efficiency gains as a result of eliminating manual verification steps and through an increase in straight-through processing.

Real-time cash flow underwriting models

A promising use of alternate data is the emergence of real-time cash flow underwriting models. Cash flow underwriting is the practice of looking at income and expense transactions to determine if an applicant’s free cash flow supports the loan or credit line. Subprime and commercial lenders have been doing cash flow analysis on borrowers for decades, but it has historically been a manual process (for example using a spreadsheet) and it caused delays in the underwriting process. For applicants with poor credit or for larger loans, waiting for this analysis was the only option and accepted as part of the process.

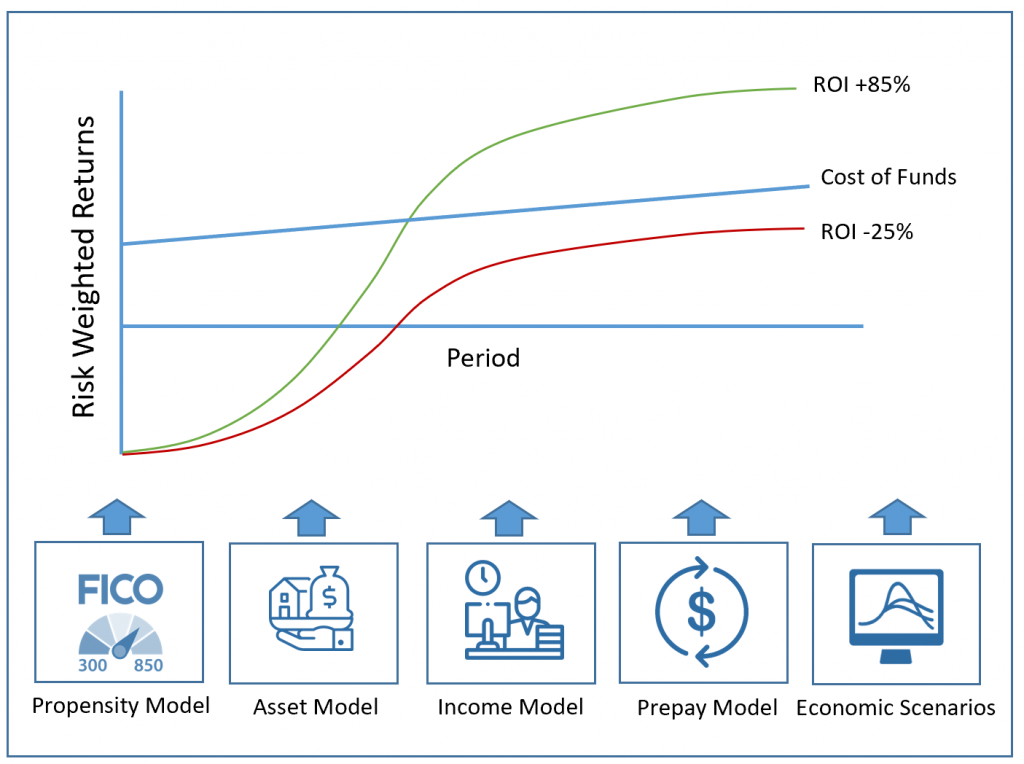

With the availability of detailed banking data and more sophisticated credit decision engines, real-time cash flow underwriting models are becoming popular across credit segments. Cash flow models can assign risk probabilities to each aspect of an applicant’s financial life. Income streams can be assigned a probability of interruption. If income is interrupted, expenses can be scored for how essential or fungible they are, and debts can be ranked to predict which are likely not to be paid in the event of a cash crunch.

These calculations can be used to simulate overall credit risk and expected profitability in milliseconds, helping lenders book more profitable loans. McKinsey reports that lenders can realize a 20-40 percent reduction in loss rates by using credit risk models that more precisely determine a customers’ likelihood of default.

Challenges deploying next-generation credit models

Many lenders struggle to build and deploy next-generation models. Many organizations have a deeply ingrained culture of risk avoidance when it comes to credit models, and often a seemingly insignificant threshold change can take months to test, document and deploy. The thought of approaching credit risk from a completely new perspective can be paralyzing for some teams.

Risk aversion is not the only barrier to adopting alternate underwriting models. Many lenders have limited IT resources and rely heavily on third-party technologies to deploy credit decisions. Modern data sources can have sophisticated layouts (similar to the credit bureaus), and their current technology does not support a data vendor the lender can’t leverage it.

Taking an alternative approach to credit models can be paralyzing for risk averse teams.

Accessing the data is only half the battle. Modern credit models utilize more than simple attributes calculated from the data, they often create risk or propensity weighted projections using sophisticated calculations. Adding to the complexity, these calculations must be run both while training and tuning models, as well as in the production decision environment. Even for lenders with software development teams, creating solutions to automate these simulation models can be difficult.

Next-generation credit decision engines

An emerging class of next-generation credit decision engines are solving this problem using no-code technologies. Teams creating next-generation credit models and implementing real-time decision engines now have the power of no-code tools to more effectively create advanced logic that traditionally required custom software. Eliminating a custom code step can not only accelerate a lender’s path to creating a modern credit model, it can significantly reduce the friction of updating credit models and allow lenders to be more competitive by reacting to market or economic changes.

Modern credit decision engines go beyond business rules and risk scoring. The scope of decisioning includes not only risk or fraud, but now includes application intent, pricing elasticity and conversion probability modeling. To support this role, next-generation platforms will provide a seamless data integration hub that will support plug-and-play connectors to a wide range of vendors as well as provide out-of-the-box logic and analytics that will allow credit issuers to leverage multiple alternate data sources in their decisioning.

Coming up next…

In my next post I will talk about the importance of a frictionless credit origination and how modern credit decision engines have taken a much more important role in that experience.

Comments are closed.