Client demands are growing for management consultants. Increasingly, firms are expected to be more than service providers, they are being asked to be partners in their clients’ digital transformation (CB Insights).

With over 30 years of experience working in consulting for the municipal bonds industry, Mark Kaveny has experienced this first-hand. To meet the growing needs of his clients, his firm is now developing custom applications that bring new value to their client’s processes.

Mark is part of a 7-person team at CSG Advisors that also provides advisory services to municipal bond issuers to finance affordable housing programs. CSG has traditionally served as a financial advisor, also providing specialized quantitative modeling and program advice.

Housing Finance Agencies are required to provide financial reporting to lawyers, rating agencies, investors, and the IRS.

CSG’s clients work in a highly regulated industry. Housing Finance Agencies (HFAs) are required to provide financial reporting to lawyers, rating agencies, investors, and the IRS. The regulations and accompanying reports are data and computationally intensive. Additionally, there are specific instructions on how data should to be entered, processed, calculated, and submitted to their tax council and other interested parties.

In some instances, electronic records had to be manually inserted into spreadsheets and required manual reformatting and data cleaning.

As an example, to build their arbitrage rebate tax reports every year, one such HFA client was manually downloading custodian bank web portal reports. They would put the hard copy of the report next to their keyboard and manually rekey tens of thousands of dates and dollar amounts into a spreadsheet. This was an extreme case, but even in some instances electronic records had to be manually inserted into spreadsheets and required manual reformatting and data cleaning. This process was awkward and time-intensive. The resulting spreadsheets were error-prone and required multiple review cycles. Once the errors were removed and the results manually verified, the spreadsheet summaries were manually copied into a document format and sent to the IRS.

There had to be a better way to prepare and transform data.

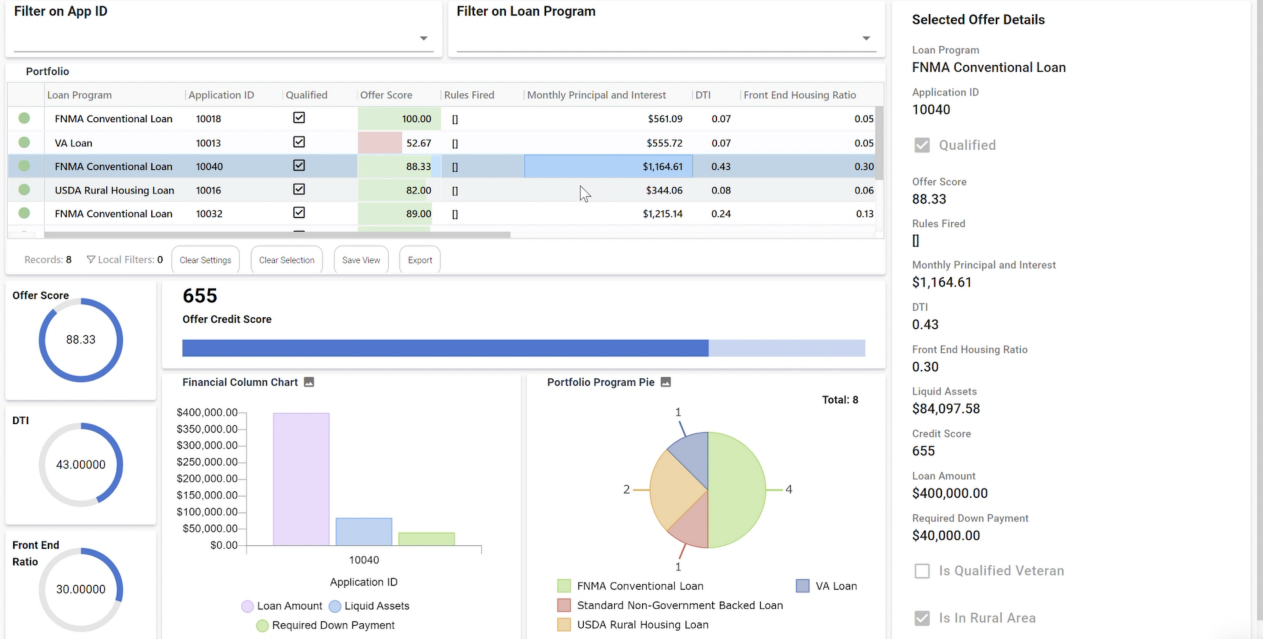

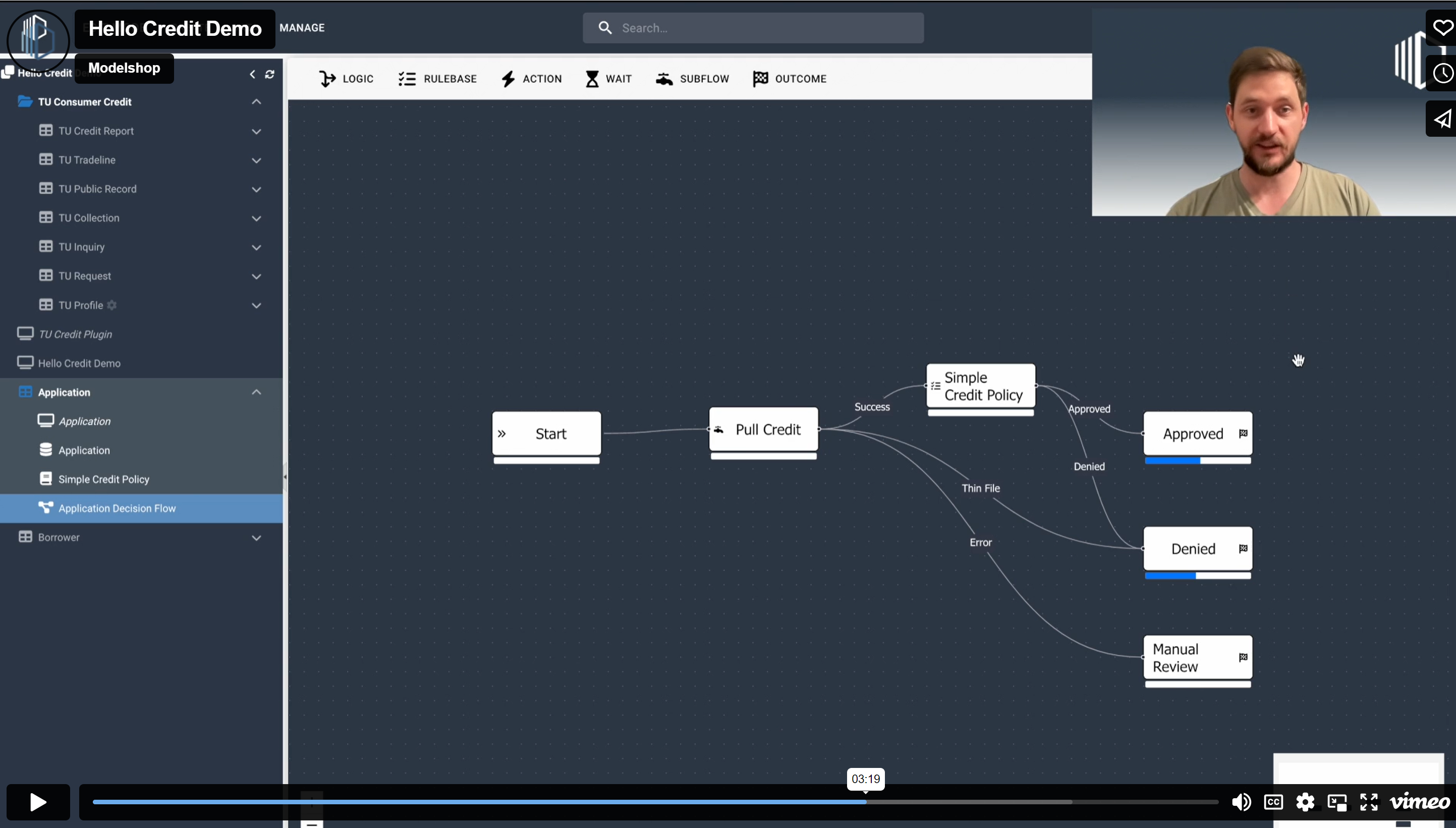

Mark saw an opportunity to improve this process. He knew there were better tools to prepare and transform data. After evaluating data and analytic platforms he chose Modelshop because of its configurability and ease of use. Modelshop gave his client a familiar tabular view but with a much easier way to add new data periodically. More importantly, Modelshop was an online tool that allowed Mark to collaborate with his client much more easily. Using their existing spreadsheets as a guide, he configured their model in Modelshop and showed the client his proof of concept solution.

Once the model was created, the new process for the client became quite simple.

Even as a new user, it took only a few days to configure the model. Once the model was created, the new process for the client became quite simple and straightforward. In the future, an employee will download data quarterly from their ledger system and custodian bank web portal and upload it through a Modelshop data connector. The model will automatically map the new data to each tax plan and flag any data quality issues. If new accounts are detected, they will be displayed in a dashboard and will enable the client to quickly and easily create new tax plans as needed and map the account(s) to the correct tax plans. Once all data relationships and data exceptions are resolved, a pro forma arbitrage rebate report is automatically generated that can be sent directly to tax counsel and the IRS.

What used to take 70 hours every year, now takes 2 hours, which frees up 15% of a full-time employee’s time.

What used to take 70 hours every year, now takes 2 hours, which frees up 15% of a full-time employee’s time. The client has been very happy with the results and is excited to convert other models to Modelshop as part of their digital transformation initiative. Based on CSG’s unique knowledge of the client’s activities, the project has given Mark and CSG the opportunity to provide a valuable service to the client, generating substantial savings and automating a number of key financial management functions.

Looking forward, Mark sees opportunities to create applications like this for other CSG clients. He has started to evaluate Modelshop’s APIs to provide a direct connection to data providers and is looking at Modelshop’s AI tools to more effectively automate manual processes while reducing client risk.

The solutions they deliver to their clients are much more collaborative, enabling greater immediacy and financial control for the clients.

Using Modelshop, CSG Advisors has the opportunity to provide highly valuable, solution-based offerings, precisely tailored to clients’ needs. The online applications they deliver to their clients are much more collaborative than the spreadsheets they are replacing, enabling greater immediacy and financial control for the clients and allowing Mark and his team to deliver a more attentive level of service.