Make optimal personalized credit offers powered by AI

Increase account growth and reduce risk by delivering personalized credit offers at the perfect time.

Portfolio Analysis

Get a 360-degree view of your portfolio performance

Portfolio analysis and performance metrics are essential for credit union staff to track and optimize key KPIs, including engagement levels, transaction frequency, service usage, Lifetime Value (LTV), and Return on Assets (ROA).

A deep portfolio analysis provides valuable insights into member behaviors, preferences, and financial needs. This data-driven approach also enables staff to tailor their strategies and offerings, ensuring they are aligned with member expectations and market trends.

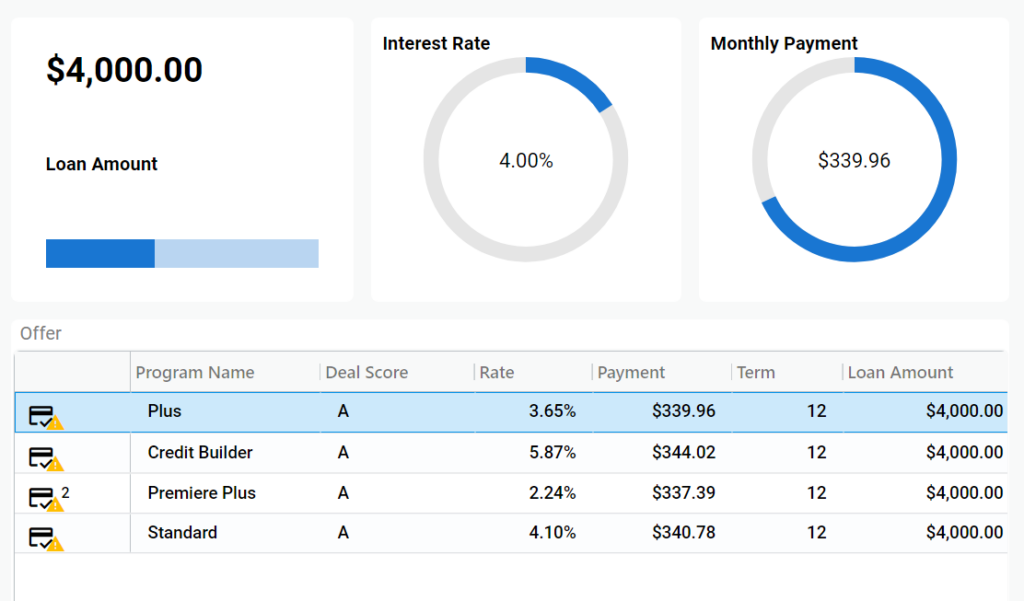

Cashflow Modeling

See the full picture with open banking data

Combining cash flow modeling with open banking data provides credit unions with a powerful tool to enhance financial offers and member service. Cash-flow modeling provides a detailed analysis of a member’s financial inflows and outflows, allowing credit unions to understand their financial health and predict future cash positions. When integrated with open banking data, which includes real-time financial information from multiple sources, this modeling becomes even more accurate and comprehensive.

By leveraging this combined approach, credit unions can offer personalized financial products tailored to each member’s unique situation, ultimately improving member satisfaction and loyalty.

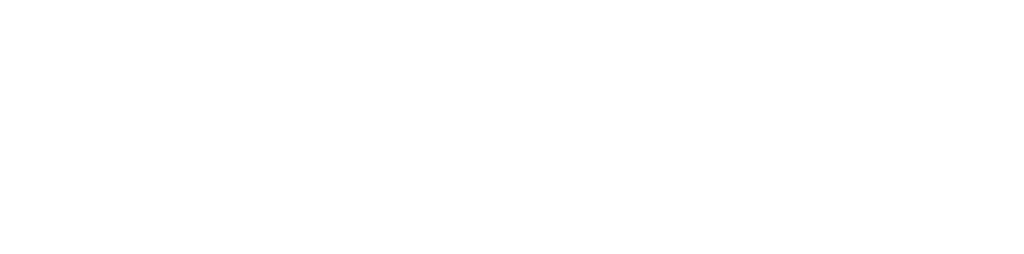

Personalized Pricing

Say "YES" to More Members with Personalized Financial Products

The solution provides intuitive, data-driven offers tailored to the unique needs of credit unions’ members. We leverage data modeling, advanced analytics, and machine learning to offer personalized risk-based and member-centric financial products and offers to credit union members.

Modelshop empowers your staff to provide real-time and highly personalized financial products, fostering stronger member relationships and building on the credit union’s “people helping people” mission while ensuring revenue growth objectives.

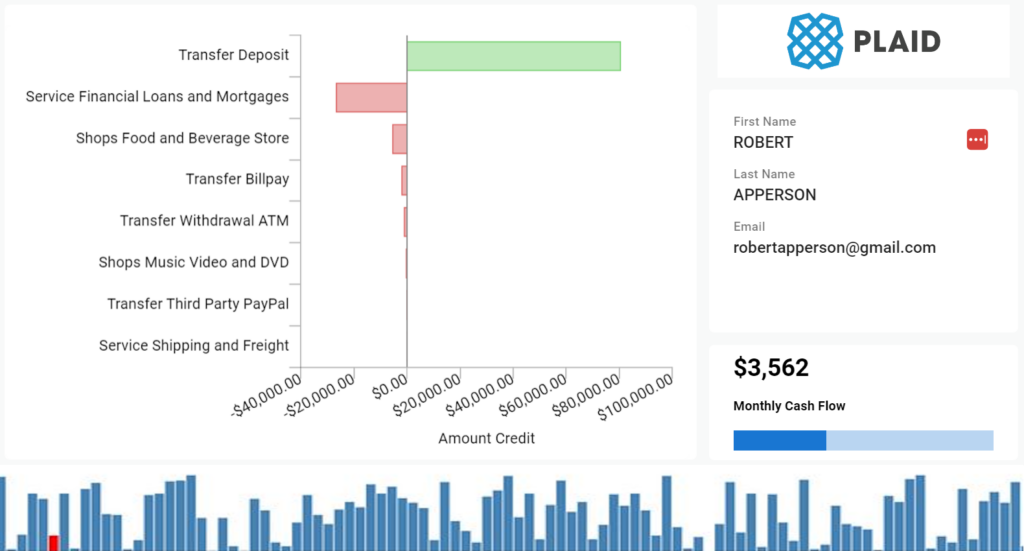

Real-time Offer Optimization

Leverage AI automation to reduce human error and accelerate consistent approval processes

Real-time offer optimization transforms the member experience for your credit unions by providing instant personalized offers that align with members’ immediate needs and preferences.

With our automation capabilities, your team can streamline tasks, reduce manual errors, and optimize workflows. This also reduces the burden on staff, improves efficiency, and speeds up member service.

How Offer Optimization Works

Assess your current risk strategy

Evaluate new data sources and AI tools

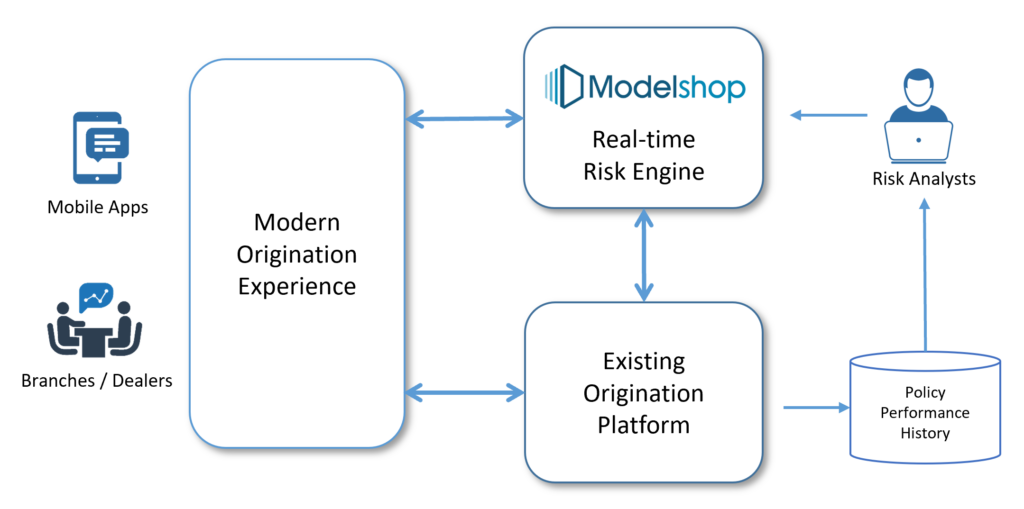

Build and deploy an AI risk engine

Monitor and improve risk performance

Book a Call With Modelshop

Book a consultation with the Modelshop team to discover how AI-powered automation can optimize your credit offers.