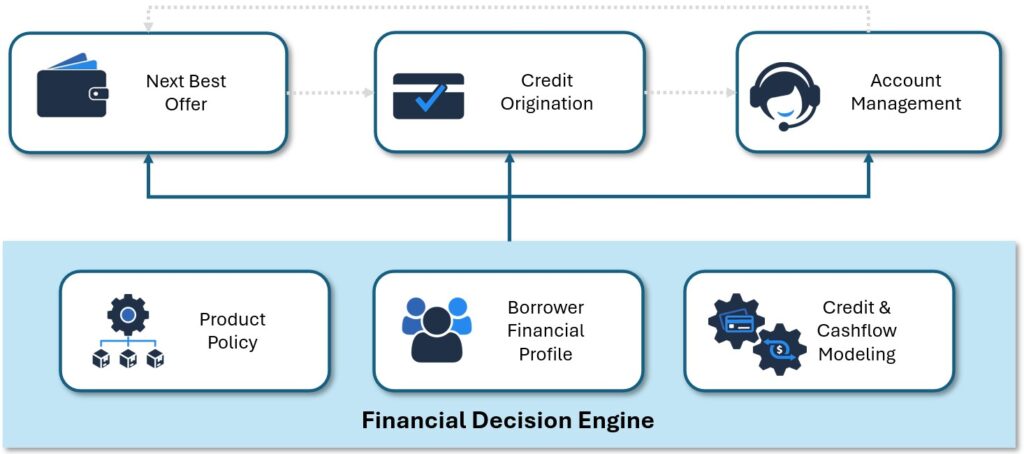

Financial Decision Engine

Power real‑time credit decisions, personalized offers, and lifecycle actions with a single Financial Decision Engine.

The Financial Decision Engine centralizes product rules, borrower intelligence, and forward‑looking cashflow signals so banks and fintechs can make faster, fairer, and more profitable decisions. Built for explainability, auditability, and speed, it reduces time‑to‑decision while improving conversion and portfolio performance.

Product policy

- What it does:

- Policy authoring — create, test, and version eligibility, pricing, and compliance rules without engineering.

- Policy simulation — run what‑if scenarios to measure revenue and risk impact before launch.

- Compliance audit trail — full decision traces and human‑readable rationales for regulators and disputes.

Why it matters: Product policy ensures consistent, compliant decisions across channels and campaigns, enabling rapid product launches and controlled risk exposure.

Borrower financial profile

- What it does:

- Policy authoring — create, test, and version eligibility, pricing, and compliance rules without engineering.

- Policy simulation — run what‑if scenarios to measure revenue and risk impact before launch.

- Compliance audit trail — full decision traces and human‑readable rationales for regulators and disputes.

Why it matters: A single borrower profile eliminates data silos, powers accurate pre‑qualification, and improves underwriting consistency while supporting transparent customer conversations.

Cashflow modeling

- What it does:

- Transaction classification — convert deposits and debits into income and expense categories for accurate affordability.

- Forward projection — short‑ and medium‑term cashflow forecasts with seasonal and stress adjustments.

- Event detection — detect life events and liquidity shocks to trigger proactive interventions.

Why it matters: Dynamic cashflow modeling provides forward‑looking affordability and liquidity signals that improve credit decisions and reduce defaults.

Outcomes and benefits

- What it does:

- Consistency: One source of truth for eligibility, pricing, and servicing.

- Speed: Millisecond decisioning for digital channels.

- Explainability: Decision traces that support compliance and customer trust.

- Business impact: Higher conversion, optimized pricing, and better borrower outcomes.

Request a demo to see the Financial Decision Engine in action and get a tailored pilot plan that maps to your data and integration needs.