For decades, credit marketing has relied on a frustratingly vague model. We’ve all seen it: solicitations for “rates as low as 2.9%” or “limits up to $50,000.” Then, after going through a long application, you find out you qualify for something far less attractive, if you qualify at all.

It’s a lose-lose. Lenders waste money sending out mass offers, and consumers are left disappointed and mistrustful.

That era is coming to an end.

As lenders rapidly embrace generative AI and open banking, we’re on the edge of a fundamental shift. The future isn’t about teaser rates—it’s about firm, personalized, instantly bookable offers designed around each consumer’s actual financial profile.

From Vague Promises to Firm Commitments

The old “as low as” playbook just doesn’t work anymore. Lenders send millions of solicitations, but the fine print applies to only a lucky few. Consumers know it. They expect disappointment.

Here’s the fallout:

- Frustrated consumers who lose trust when their “3% offer” turns into 15%

- Wasted spend on marketing to people who don’t need credit

- Clunky processes where you only learn your real rate after a full application

- Low conversion rates from generic, irrelevant offers

Now flip the model. Instead of teasing, lenders can make precise, personalized commitments up front.

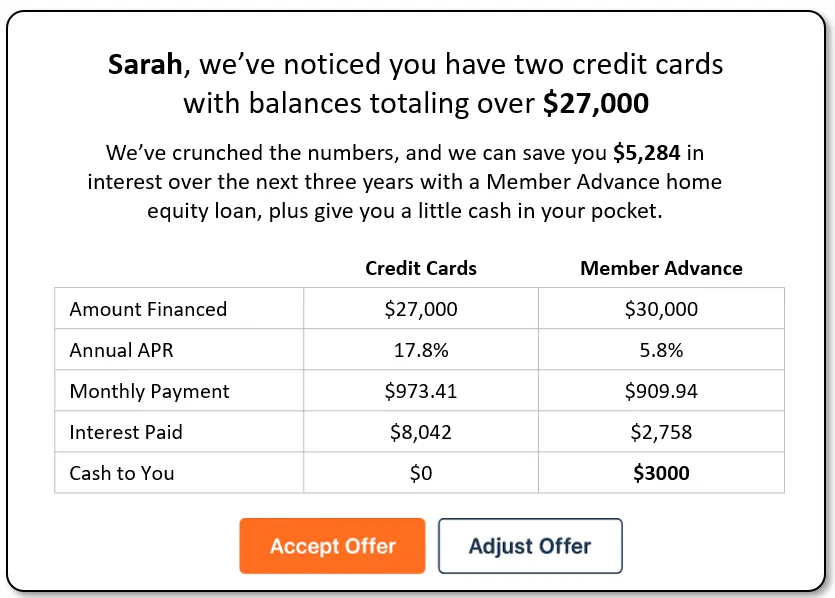

Imagine receiving a notification that says:

That’s not a future vision—it’s already happening. Some fintechs are there, and it’s only a matter of time before this becomes the norm.

Why Generative AI + Open Banking Change Everything

Two big forces are converging:

Open banking gives lenders a real-time, holistic view of consumers’ finances:

- Account balances and cash flow

- Verified income through payroll data

- Debt obligations via actual payments, not just reported balances

- Spending and saving patterns

- Payment consistency and timing

Instead of guessing, lenders see the full picture: creditworthiness, stability, capacity, and even product fit.

Generative AI is the intelligence layer that brings it to life. Unlike static credit scores, AI can:

- Weigh hundreds of data points in context for dynamic risk assessment

- Match consumers to the product that truly fits their situation

- Continuously optimize terms and messaging for maximum relevance

Together, these forces mean credit offers that are smarter, faster, and genuinely personal.

Why This Feels Different

This shift is one of those rare win-wins.

- Consumers get transparency and relevance instead of disappointment.

- Lenders get better conversion and risk management instead of wasted marketing.

For me, though, the biggest change is trust. When offers are real, when you consistently deliver what you promise, relationships shift. Consumers stop bracing for bad news and start believing in the brand. That’s powerful.

What Comes Next

We’re still at the early stages, but the path forward is clear:

- Predictive offers that anticipate needs

- Dynamic pricing that adapts in real time

- Credit embedded seamlessly into everyday experiences

The days of spray-and-pray teaser rates are numbered. What’s replacing them—personalized, precise, immediately actionable offers—creates a better experience for everyone.

Fintechs are already moving fast, building a huge lead. The open question: how quickly will traditional lenders catch up? I’d love to hear where you are in your journey.

Join the conversation and subscribe to this newsletter on LinkedIn: