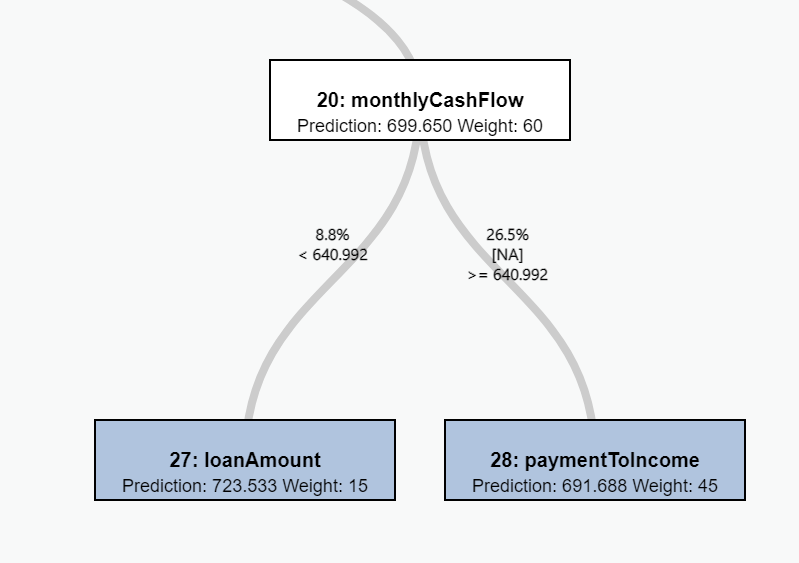

Understand an applicant's complete financial picture

Banking transaction data provides a more accurate and up-to-date representation of an applicant's potential than credit data alone.

Access more diverse customers using banking data

Traditional credit scores and financial ratios don’t tell the whole story. Younger generations, immigrants and applicants with limited credit leverage can still be great customers. Banking data give a clearer picture of financial responsibility and helps serve a broader customer base.

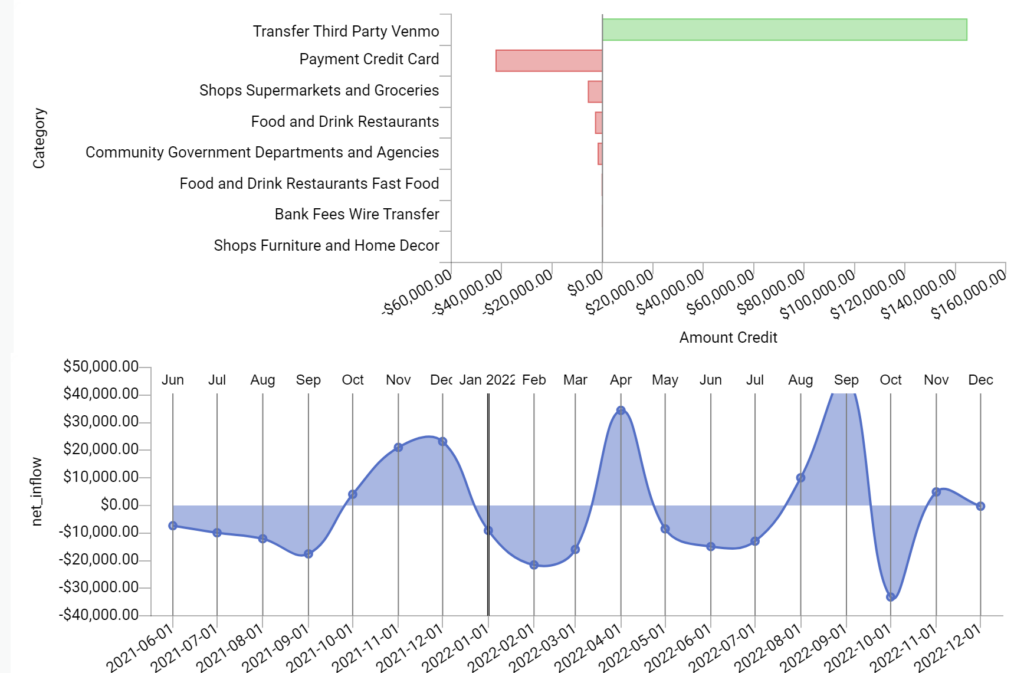

Cash Flows

Predict ability to pay based on history

Calculate historic and predicted monthly inflows, outflows and discretionary spending levels with AI transaction classification and time projections

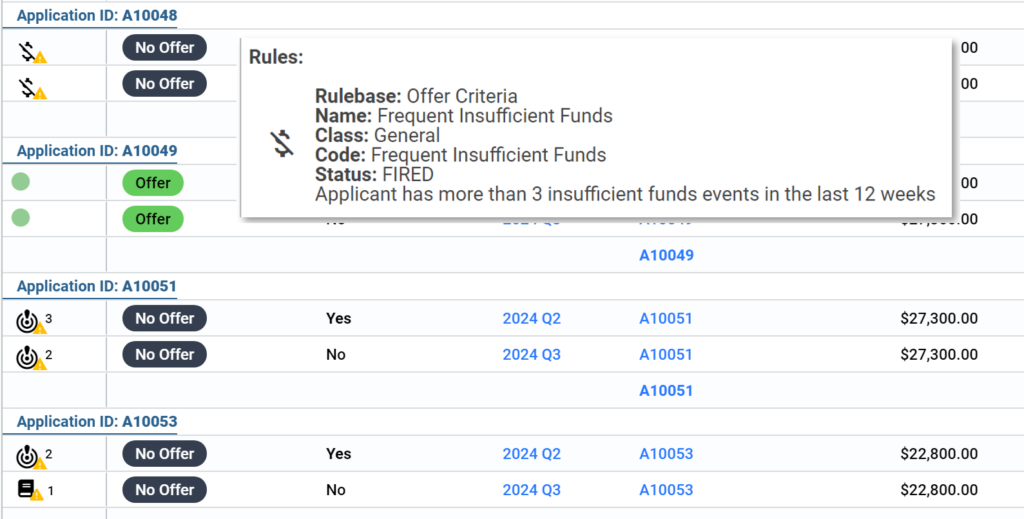

Risk Indicators

Identify banking behavioral risk signals

Negative balances, non-sufficient funds, high-risk borrowing and interruption of historic income streams can provide early indicators of high-risk applicants

Increased Inclusion

Access applicants with limited credit history

Often great potential applicants do not have a traditional credit history. Access younger, under-banked and immigrant customers by looking past the credit report.