Deliver personalized pricing for a better customer outcomes

Next-generation pricing strategies can increase conversions and deliver better portfolio outcomes

Capture a broader customer base while reducing risk

Let’s face it – setting the right price for a credit relationship is the most important factor that separates good from bad lending results. Flexible, personalized pricing can increase customer conversions, reduce defaults and build customer trust.

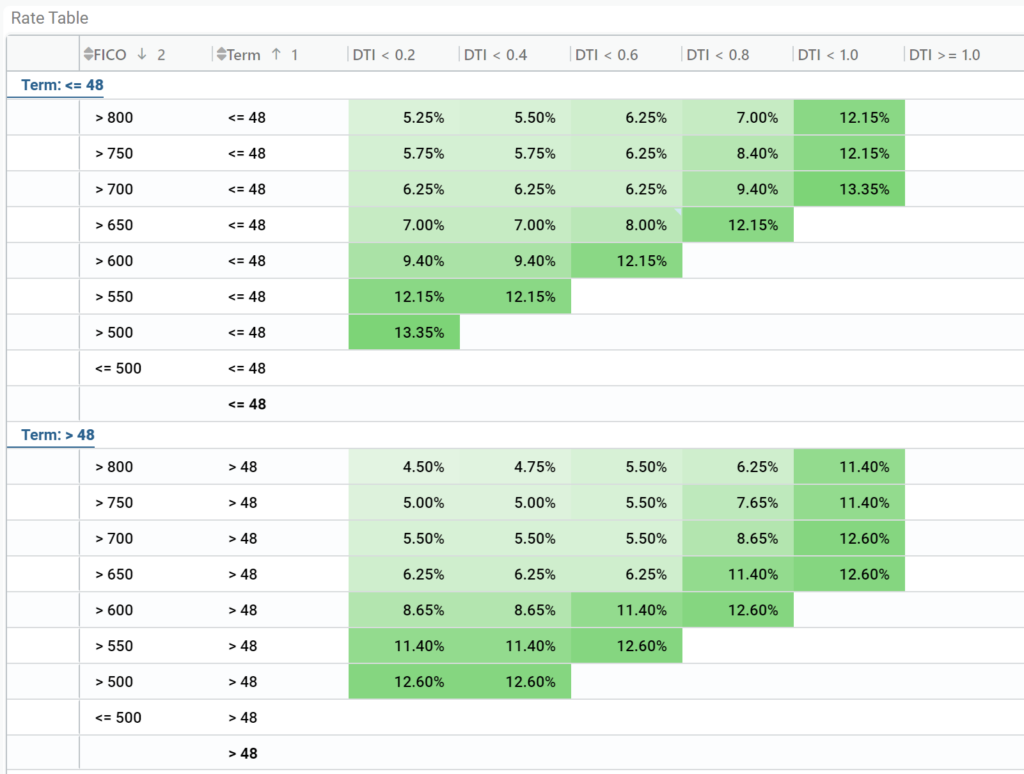

Unlimited Pricing Segments

Automate Any Pricing Strategy without Code

Any pricing strategy can be implemented quickly without coding, including dynamic pricing calculations, rate adjustments and unlimited pricing dimensions.

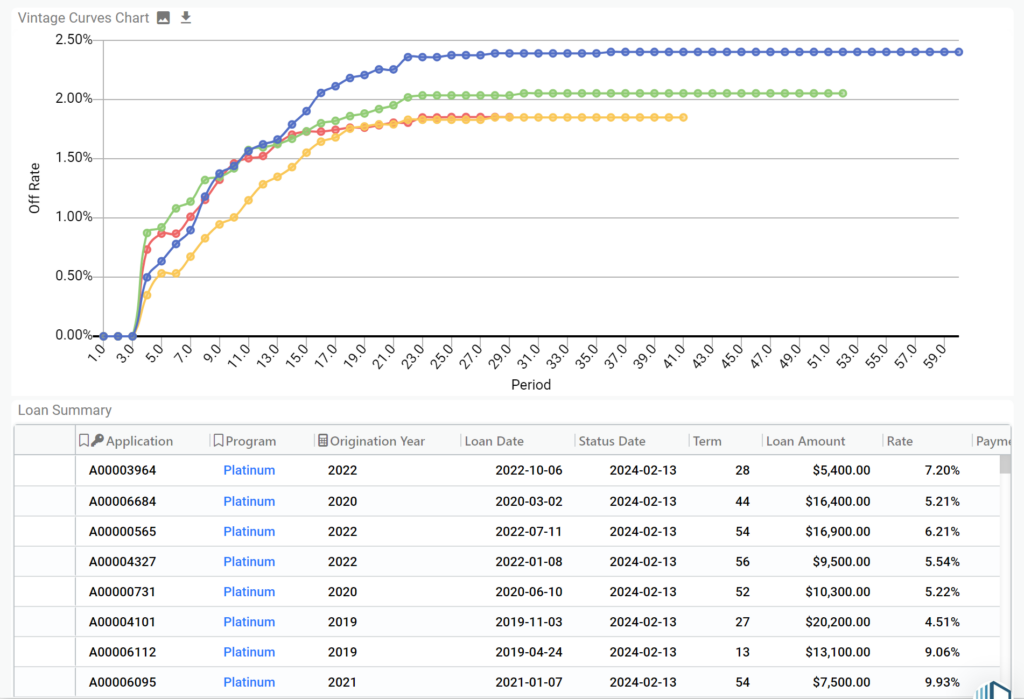

Real-time Risk Based Pricing

Dynamic Pricing Based on Risk Projections

Classic pricing segmentation strategies lack precision. Modelshop’s dynamic pricing engine uses risk projections to capture the potential value of each individual applicant.

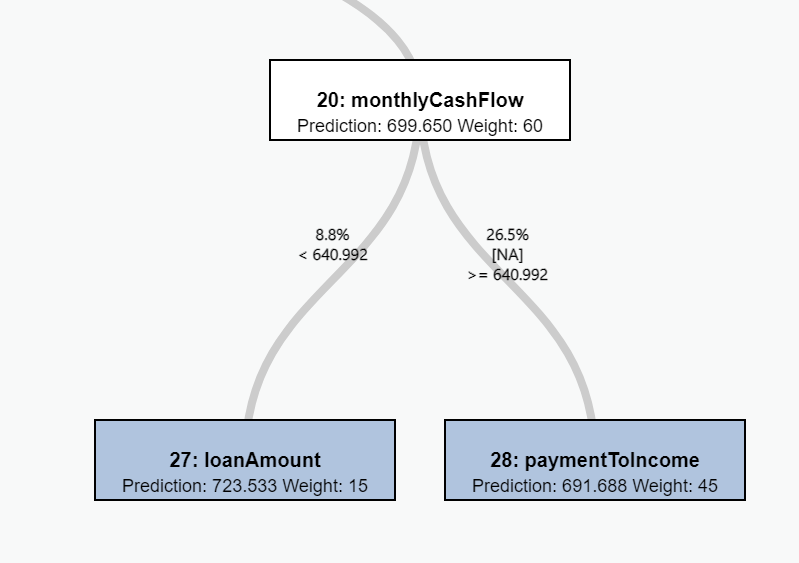

Dynamic Repricing

Recalculate Pricing on the Fly

Applicants want choices and Modelshop’s pricing engine handles real-time credit repricing while a loan or credit relationship is being originated.