Insurance Underwriting Models

Design, optimize and deploy insurance underwriting models that leverage new data sources and can be deployed as real-time services - without code.

Download DatasheetDesign, optimize and deploy insurance underwriting models that leverage new data sources and can be deployed as real-time services - without code.

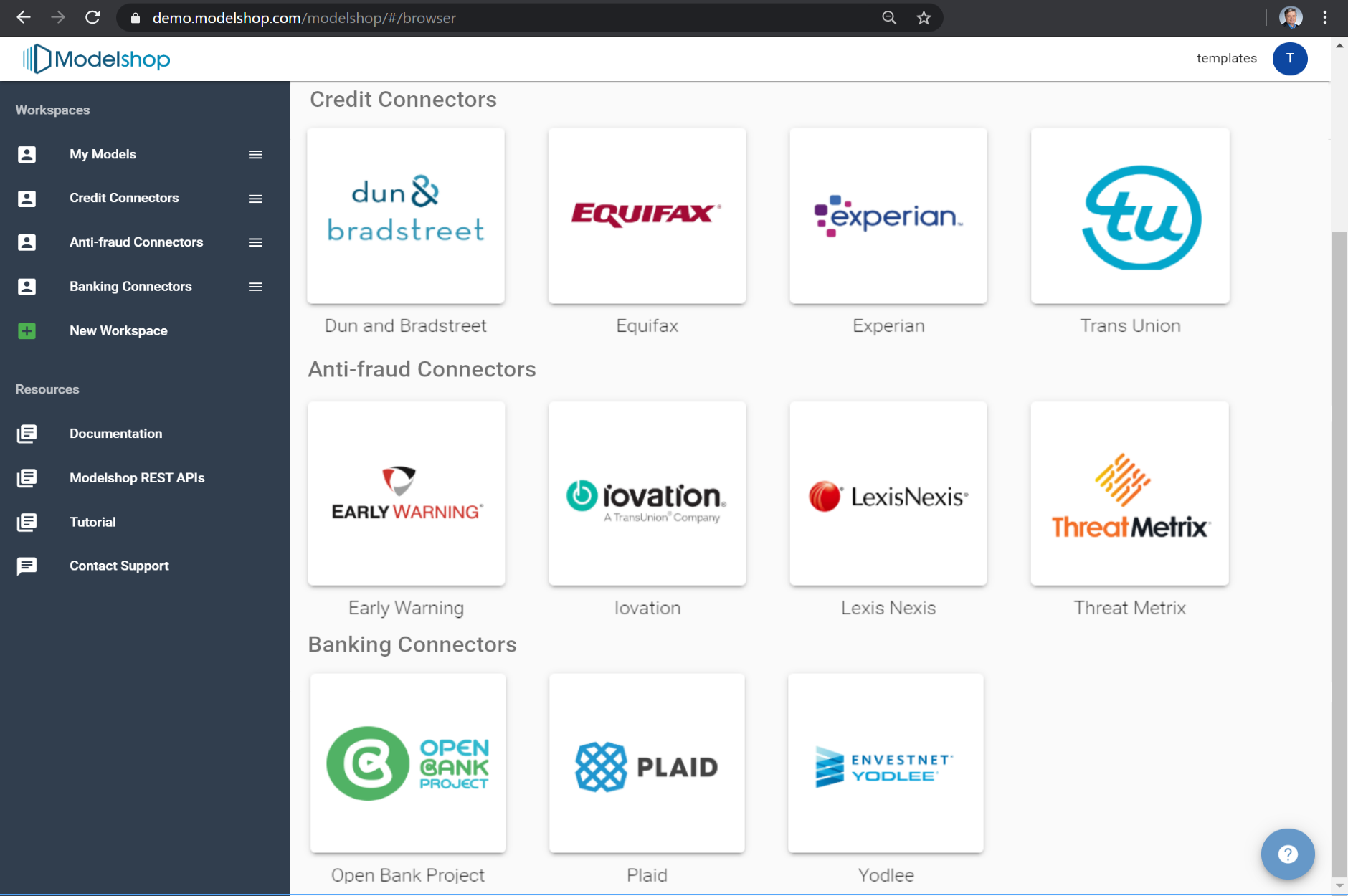

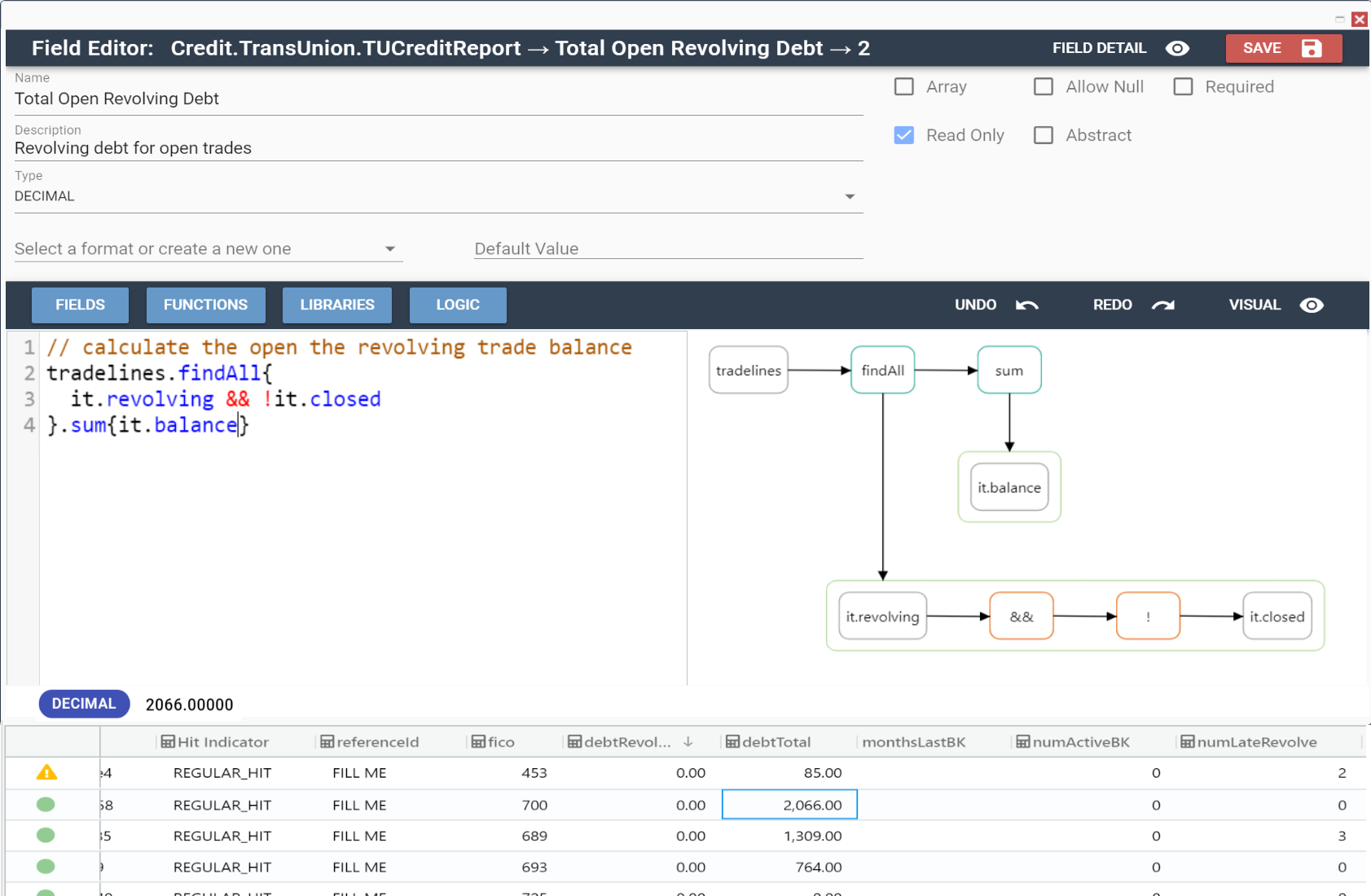

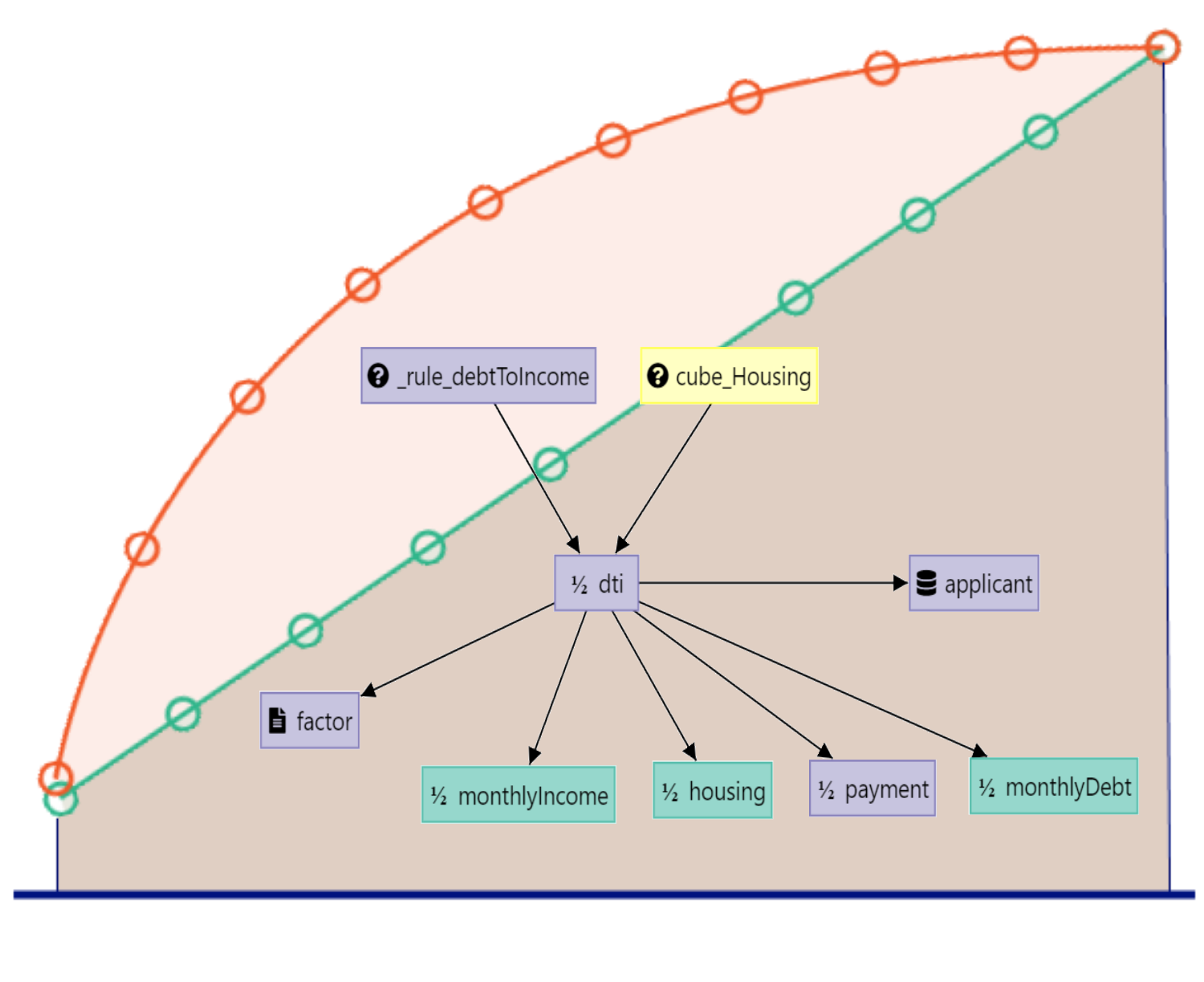

Download DatasheetInsurance decisions are becoming more targeted and must leverage new data sources to remain competitive in today’s market. Modelshop provides unlimited flexibility to add new data, create new variables and deliver higher performing models.

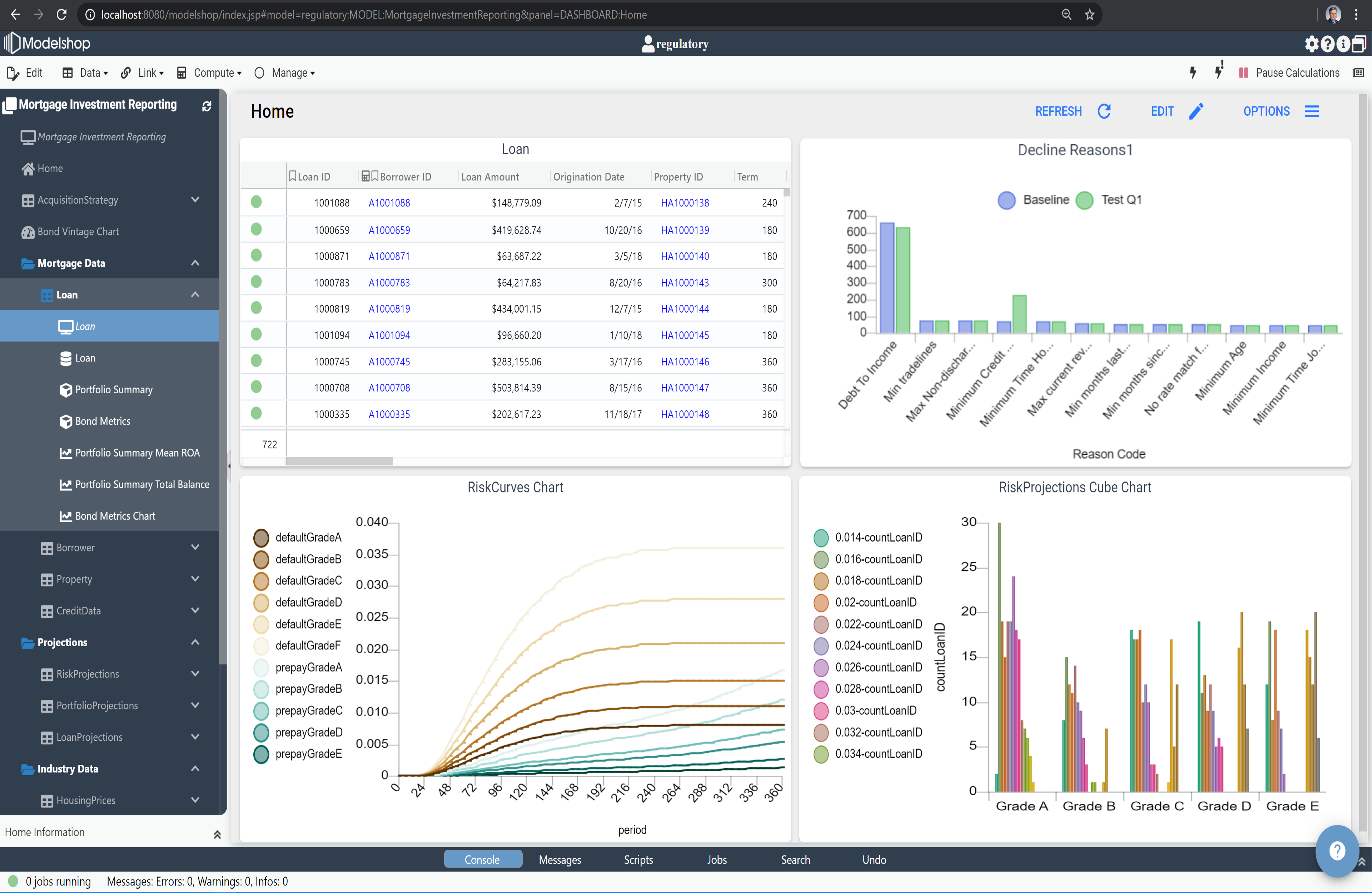

Move calculations and analysis to your internal cloud, increasing cross-team collaboration and transparency.

Modelshop provides an ability to back-test and run forward projections on your credit policy before you deploy it. Simulation, optimization and machine learning are built into the modeling process and do not require coding.

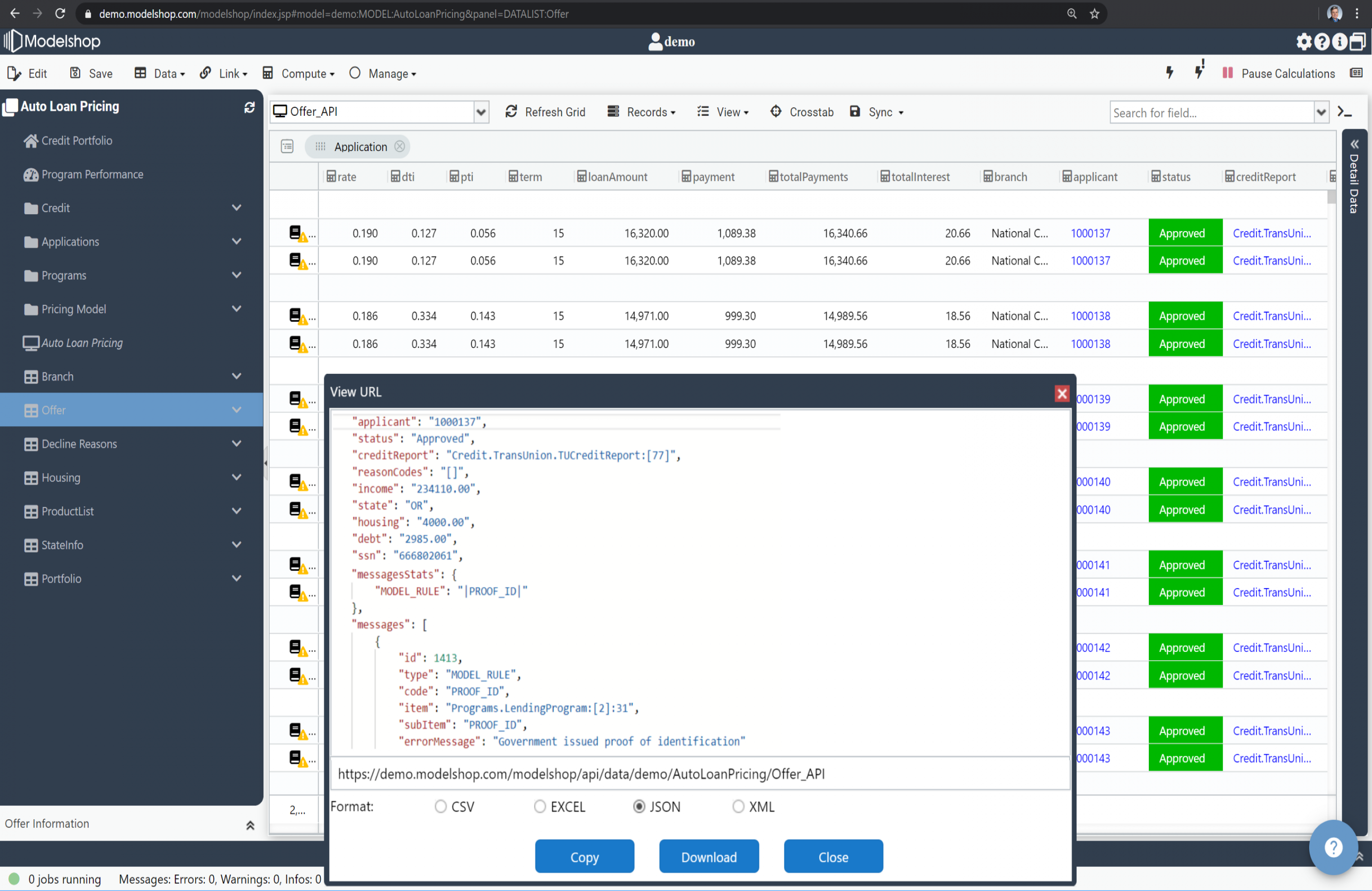

The days of waiting weeks or months to deploy your underwriting models to production are over. Modelshop models are ready to be deployed as scalable, real-time services the moment they are built. Skipping the coding step can accelerate new insurance strategy deployment from months to hours.

Traditional actuarial tables sometimes aren't enough. Modelshop enables underwriters to enhance their current models with integrated machine learning tools that are fully transparent and that can be explained to regulators.

Create a trial account and start building your own models based on our insurance underwriting template today.

Create your own insurance model